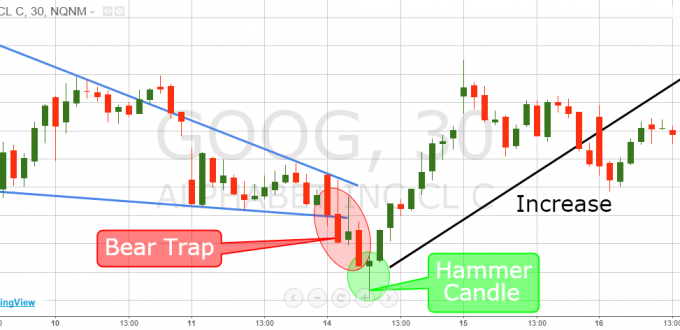

What is a Bear Trap?

The bear trap is a bearish reversal pattern that forms after a prolonged uptrend. The pattern gets its name because it “traps” bulls who expect the uptrend to continue.

The bear trap pattern consists of three candles:

- The first candle is a strong bearish candle that closes near the lows of the session. This candle creates bearish momentum and traps the bulls who are expecting the uptrend to continue.

- The second candle is a small bearish candle that closes near the highs of the session. This candle creates bearish indecision and further traps the bulls.

- The third candle is a strong bearish candle that closes below the lows of the first bearish candle. This confirms the bearish reversal and signals that the uptrend has ended.

What Does a Bear Trap Signal?

A bear trap signals that the uptrend has ended and that the market is likely to move lower in the near term. The pattern is often seen at market tops and can be used to enter bearish positions.

The bear trap pattern is not as reliable as some other bearish reversal patterns, such as the bearish engulfing pattern or the bearish harami pattern. However, it can still be a useful tool for traders to identify potential market tops.

How to Trade the Bear Trap Pattern

There are two ways to trade the bear trap pattern:

- Short positions can be taken when the bearish reversal is confirmed with a close below the lows of the first bearish candle. The stop loss can be placed above the highs of the second bearish candle.

- Another way to trade the bear trap pattern is to wait for a higher low to form after the bearish reversal is confirmed. This higher low can be used to enter a short position. The stop loss can be placed above the highs of the bearish reversal candlestick.

Bottom Line

Trading is a game of uncertainty, and no one knows what will happen next. It might seem like we’re onto something good only for the market to dunk on us later – but there’s always an opportunity in these situations!

As long as you stay calm under pressure (especially if your account deposit becomes larger), then it’s possible that this unfortunate event could be just what he needs to see himself getting back into trading again with more knowledge than before because even though things don’t usually work out well after such bad trades.

Connor Wilson is a 20-something crypto analyst who's been involved in the cryptosphere since early 2015. He has a background in mathematics and computer science, and first got interested in Bitcoin from reading about it on /r/bitcoin. Connor is currently focusing on developing analytics tools for blockchain projects.